Top 5 Things To Know About Student Loans

By Bill Wozniak

Understanding student loan options when deciding how to pay for college leads to less debt. At INvestEd, we want Hoosiers to earn a degree with the least debt possible so future income is not all spent on loan payments. Understanding the options available, who will do the borrowing, and the costs associated with each loan, is critical.

Our Understanding Student Loan Options page looks at your various loan options and provides tools to evaluate them. Don’t become the student that graduates college and says, “I didn’t know I borrowed that much” or “My monthly loan payments are what???”.

5 things to know when evaluating loan options:

- Know who the borrower is for each type of loan. Is it the student, the parent, or both?

- Know the costs. Interest rates may be variable or fixed and some loans have fees.

- Know when interest begins to accrue. Does your loan debt begin to grow immediately?

- Know when repayment begins. Is there a grace period or does repayment start once your loan is disbursed?

- Who is the lender? Loans could be from the government, banks, credit unions, your college, or not-for-profit organizations.

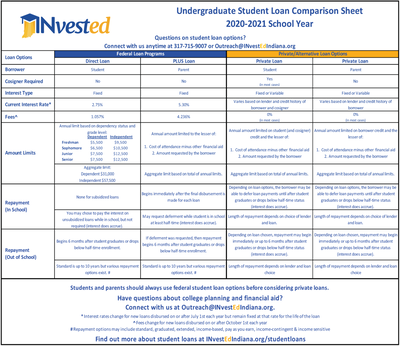

No matter which loan program you consider to help pay college costs, INvestEd is here to help. We also have a Student Loan Comparison worksheet to help you understand the various loan options.

Sometimes simply talking through the options helps lead to wiser loan choices and even minimizes debt. INvestEd is easy to connect with. Call us at 317-715-9007 or via email at Outreach@INvestEdIndiana.org.